Inflation

Inflation has not been this high in the last 3 decades and we are feeling the impacts all around us. We see it in the grocery store, places like Home Depot and now we are starting to see it in the financial markets. We will share with you a bit of the research we have done around inflation.

There are many factors driving this current round of inflation including low interest rates that increased housing prices, as well as the impact of shutting down the economy for the pandemic. Our economy is pretty complex, and it was more difficult to reopen it than was initially thought. When we look at the following chart, we can see the breakdown of what has comprised the inflation numbers. In this example a majority of the Year over Year (YOY) inflation has been caused by temporary factors like supply shortages.

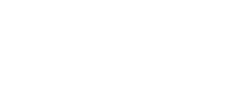

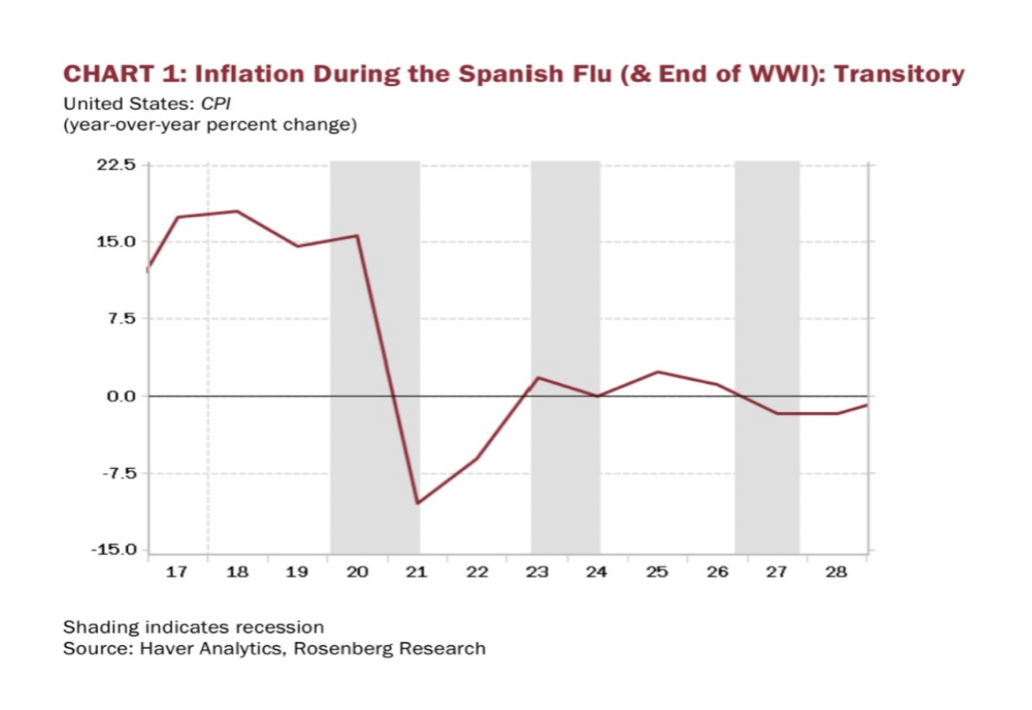

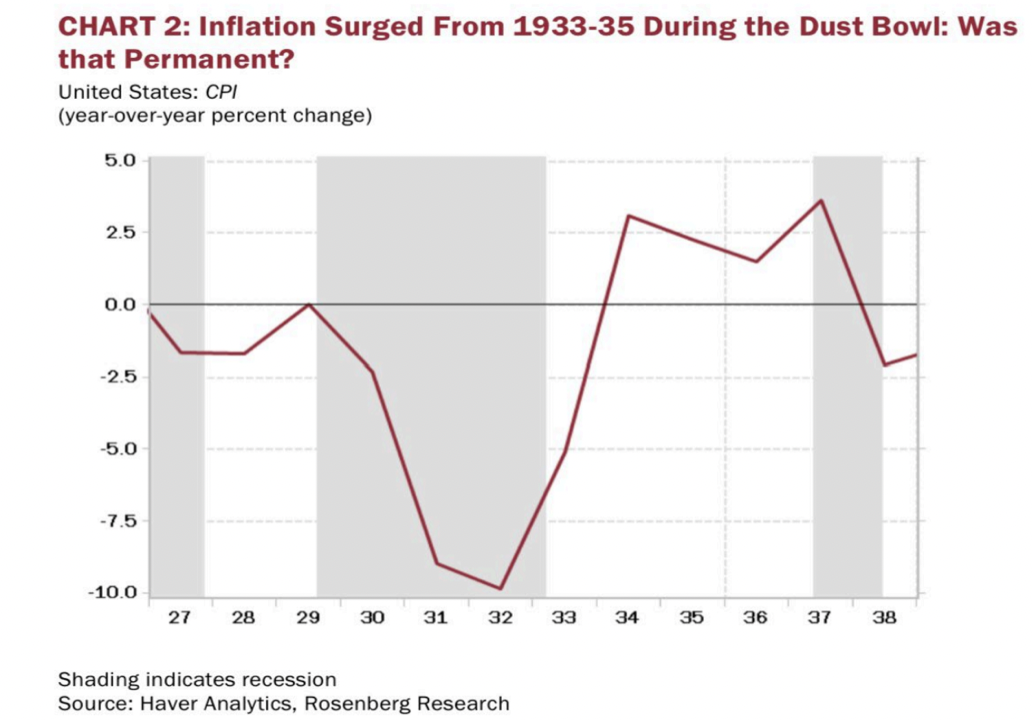

We also looked at historical data to see what inflation looked like when some significant events happened in the past that impacted the supply chain. We found that after major events, like World War 1, World War 2 and the Spanish Flu the inflation surge turned out to be temporary.

The information above gives us indications, but we cannot predict the future. The vast majority of the experts we interview are fairly confident that supply shortages will improves in 2022 and inflation should recover to a more sustainable target of 3% for the next couple of years.